How to get Home Loan in HDFC Bank? How can I Apply for HDFC Bank Home Loans through Online? Documents Required for Home Loans in HDFC:

Once you are very sure about your eligibility you can apply for the HDFC home loan at your nearest branches of HDFC bank. Ask for home loan application form and fill in the application form in detail by providing correct information.

Documents Required for HDFC Bank Home Loans

You will also be required to submit various documents which include your residence proof (like Aadhaar Card, Voter Card, and Ration Card), identity proof (Passport, Aadhaar Card, Voter Card, and Driving License), salary slips from the previous months and also the documents related to the property.

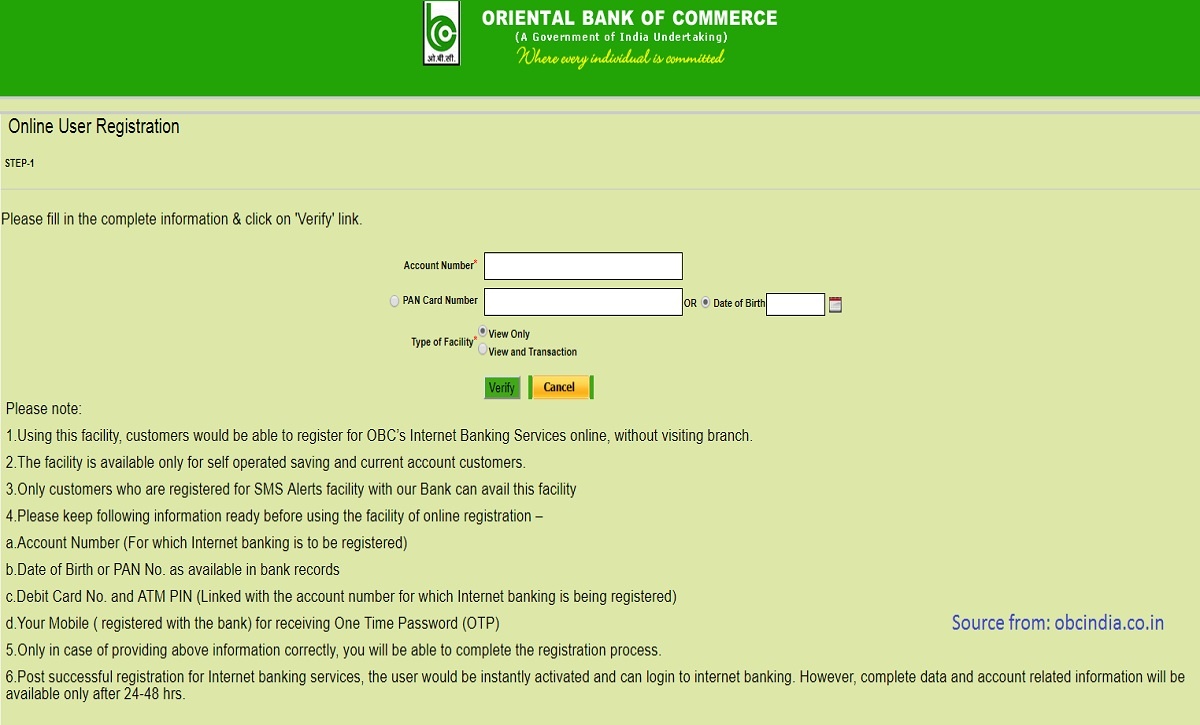

With the changing needs of the customers, the bank also made it easier for the applicants to apply for the home loan in an easier way through online.

You can apply through online and complete all the remaining procedures in the nearest branch you wish to approach.

Also be aware that there is no rule that bank always accept your application, the bank calculates your eligibility for your home loan based on various criteria and may or may not approve home loan.

Once your eligibility is good the bank will definitely approve your loan amount and the loan funds will be credited to your bank account within few days. But the fact is that the home loan takes a longer time as the amount that we apply for is usually higher than other loan amounts.

Hope the article is informative and has provided you all the information required for you to have a brief knowledge about the HDFC Bank Home loans. Keep following the page for more updates and any information about the home loans and the bank policies about the changes in the interest rate.