How to Withdrawal PF Amount through Online? PF Amount withdrawal procedure by using UAN number in online.

The world is developing very well in terms of information and technology. The government of India has also opted technology and started providing its services to its users and beneficiaries through online. There is no need for the employees to stand in lines to get things done from the officials, a you need is your UPF number and the login password along with your bank account details. You can easily apply for the withdrawal of the PF amount in online.

The main reason why most of the people in India are motivated towards government job is because of the benefits that government provide the employees after their retirement. PF amount received by the employees in their old age will be helpful for them. Though the PF amount is deducted from the employee’s salary on monthly basis, the PF amount when made available to the employees at their older ages will be very helpful for their livelihood. And also point to be noted is that PF amount has an equal share from the employer and the employee for the benefit of the individuals.

If you are in a confusion and not sure how to withdraw your PF amount but wanted to withdraw your PF amount through online then you are at the correct place. Here in this article, let’s have a look at all the steps that will help you to withdraw your PF amount through online.

Steps to withdraw PF amount through online

Before proceeding to the first step let’s make clear that you will be required to have your own registered UPN and your password.

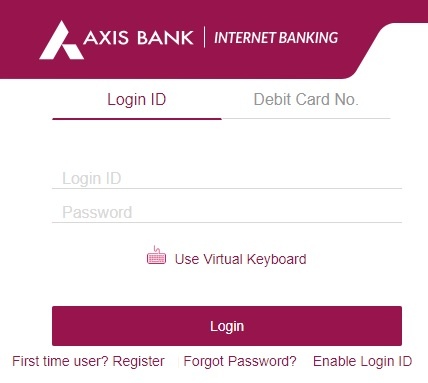

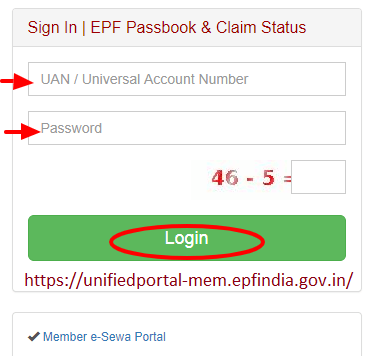

Visit the EPFO e-Seva portal (https://passbook.epfindia.gov.in/MemberPassBook/Login) and then enter your UPN and password. If you have forgotten your password then you can reset your password using your registered mobile number.

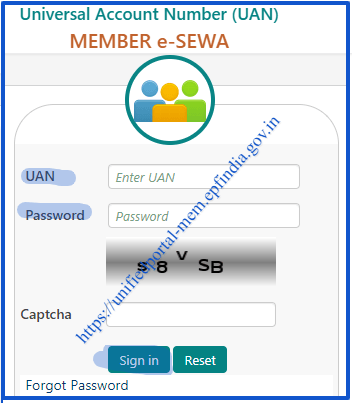

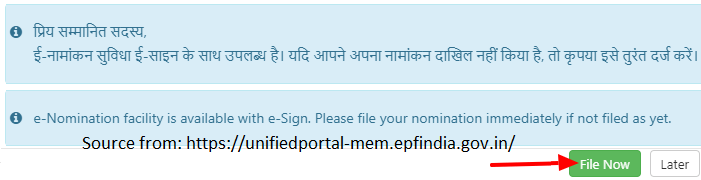

After completion of registration process, go to the Epf Member Portal i.e, https://unifiedportal-mem.epfindia.gov.in/memberinterface/

If you are having any doubt on this, you can also follow the images for better understanding.

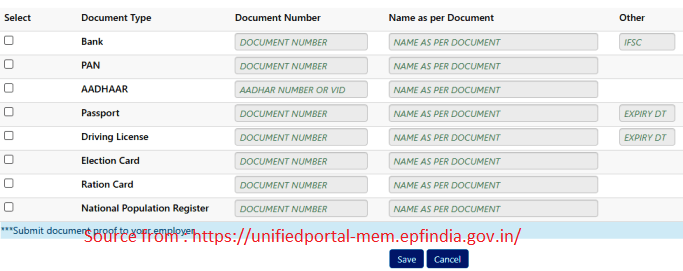

Once you entered into the page you need to check your KYC details. If you are not verified your KYC details, fill your details (Aadhaar number, PAN Number, Bank Account Details) in the space provided.

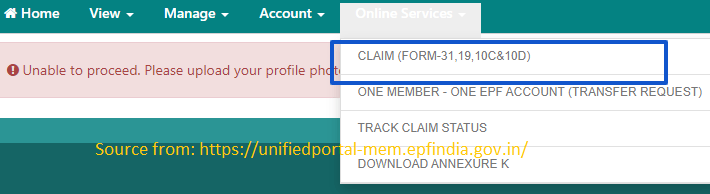

Once you are logged in, go to the online services section and then go to claim ( Form-31, 19, 10C & 10D)

![]()

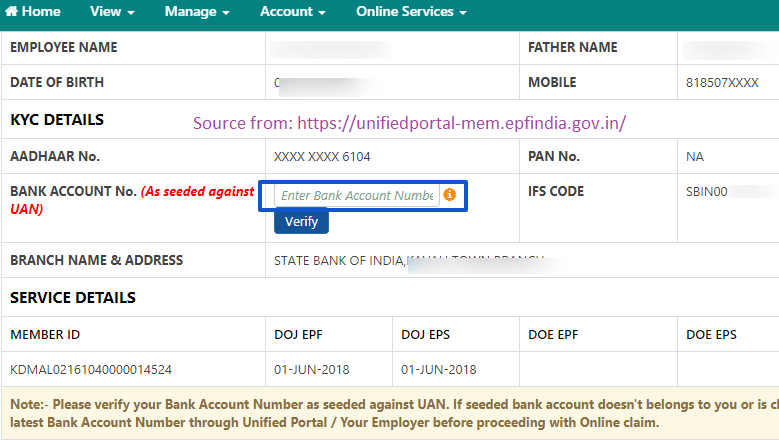

Once the page opens you will be required to enter your bank account details linked to your UPN. Make sure to enter proper details. Then click on terms and conditions and proceed further by approving for the terms and conditions. Click on proceed for online claim to proceed to next step.

In the next page you will be asked to select the reason for withdrawing your PF amount. Select the exact reason from the dropdown box provided like Covid-19 pandemic etc.

Once you select the condition for your withdrawal, you will be supposed to enter your complete address, also if you are applying for advance claim then you will be asked to upload your bank passbook details. Make sure to agree to the terms and conditions and then proceed further to the OTP.

You will receive and OTP your registered mobile number, enter the OTP you have received in the column provided. Once you enter OTP and clock enter your claim has been submitted to the higher authorities.

Hope our article has made your process of withdrawing your PF amount in a easier way and with hassle free.

Keep visiting the page for more information about the PF and the related articles and information.