How to change or reset OBC Bank MPIN for Existing Customers. Oriental Bank of Commerce Login Password Change or create new password. Create new OBC Bank Login username and password..,

Along with net banking, mobile banking also became more popular and most used banking products. Mobile banking is nothing but an application that helps to access the banking services with just one tap. One of the popular banks in public sector is Oriental Bank of Commerce which was started in 1943. From then onwards it is increasing its customer base by increasing the services offered. In order to stabilize the customer base Oriental Bank of Commerce has introduced Mobile banking and made available its mobile application in play store from November 24th 2016. From then onwards it made several updates by using latest technology. Read the article completely to know more about OBC Bank Mobile banking application and password setting.

The main features of OBC Mobile banking are e statement, instant bill payments, locating nearby OBC ATM’s, downloading Loan certificates, Transferring money through NEFT and RTGS and many more. The application can be accessed in 5 different languages and can also apply for demat account from the application itself. Overdraft facility for fixed deposit can be availed through this mobile application. One can view the Mobile pass book and even download it in the device. Requesting of new cheque book also can be done. Changing of ATM pin number can also be done from your mobile application itself. Transferring funds from one account to another account throughout day and night i.e 24*7.

- You can also search at OBC ATM Green Pin Generation

With the ease of banking transactions through mobile application OBC mobile application has also made the security stronger by adding another layer of protection called MPIN. Anyone who knows the Mobile password can access the Mobile application in order to reduce the misusage of the Mobile application MPIN has been introduced. This is just like a mobile password which is unique for Mobile bank application. Whenever the application is opened the Password should be entered. For every transaction also MPIN is required. In order to protect your Mobile banking application one needs to change the MPIN frequently.

Steps to Change or Reset OBC Bank MPIN

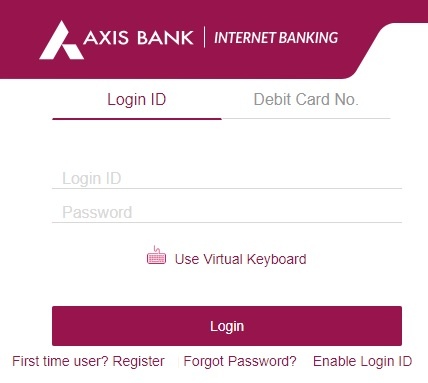

- First go to OBC Bank Net banking page and then select Retail user login.

- Then you will be directed to new page where you will be asked to enter user id. If you are a new user select register now link.

- To register you need to enter Account and Pan Card number or Date of birth.

- Click on verify and you will be able to get the user I’d and password to use the mobile banking.

- If you forget the password then enter your login I’d and press forget password.

- Now registered mobile number and Date of birth should be entered.

- An OTP will be sent to registered mobile number and by entering that OTP you will be able to enter your new password that you want to set.

Hoping that the article is helpful and information about the OBC Bank MPIN reset process.