Download/ Re-print Aadhaar Card without Registered Mobile Number? How can I download or take a re Print of my Aadhaar Card, If I lost?

Aadhar card is a 12 digit identification number provided to all the citizens of India. Aadhar card is one of the major identifications in India. It is provided to the public by UIDAI, unique identification authority of India. The aadhar card has to be applied by all the citizens of India voluntarily and has to be obtained from the authorities.

In our previous articles we have already discussed the various ways to apply for the aadhar card online and here in this article let’s get to know how to reprint your aadhar card or download your aadhar card. All of us know that we can easily download our aadhar card from any internet center if our mobile number is registered and is linked to our aadhar card. In this article let’s see how to download or reprint your aadhar card if your mobile number is not registered or if you don’t have your registered mobile number with you.

Before proceeding with the steps or procedures let’s make sure to know the fact that trying to get reprint or download your aadhar card without your mobile number will take a minimum of 5 working days as the authorities will send you your aadhar card to your registered address.

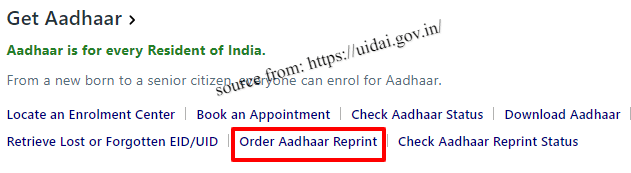

Below are the steps which will help you to reprint or download your aadhar card without mobile number.

Download/ Re-print Aadhaar Card without mobile number

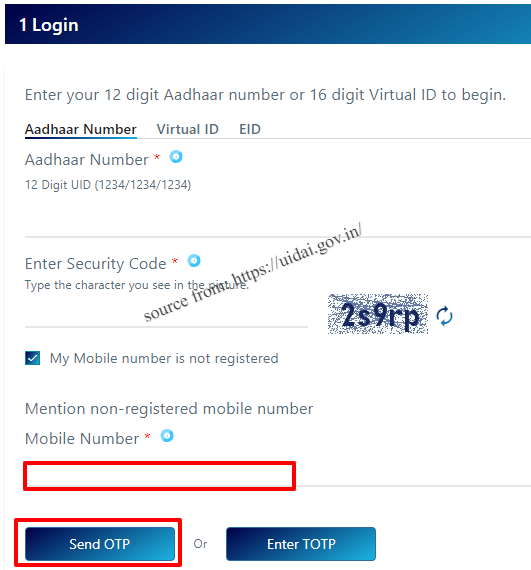

- In the first step you will be required to visit the official website of aadhar which is https://resident.uidai.gov.in/aadhaar-reprint

- Once you visit the website then search for option which says “If you do not have a registered mobile number, please check in the box”, click on the option.

- Then you will be asked to enter your unregistered mobile number. Enter the mobile number that you have with you at that moment.

- You will receive an OTP, enter the OTP in the box provided and then click on submit.

- You have now requested the authorities for your aadhar reprint and you will receive a copy of your aadhar card to your registered address through postal service.

How to Link My Mobile Number with Aadhar Card

Hope you found all the information that you require and keep visiting the page for more updates and information.